Maintaining your Income

What is transition to retirement?

Transition to retirement is a strategy that can help you reduce your working hours while maintaining the same level of income. This is achieved by drawing a pension from superannuation using the ‘transition to retirement’ condition of release.

Everyone who is preservation age (currently 55) but less than 65 years of age is eligible to commence a non-commutable allocated pension (NCAP).

Introducing NCAPs

Non-commutable allocated pensions (NCAPs) have been popular since the federal government’s transition to retirement rules were introduced in 2005. This is because NCAPs allow older Australians access to their preserved super benefits without having to retire.

What are the benefits of this strategy?

Key benefits of an NCAP strategy may include:

- The opportunity to maintain your current income and boost your retirement savings through salary sacrifice

- Supplementing your income while reducing your work hours and gradually transitioning into retirement, and

- Favourable tax rates that apply to pension payments for those aged 55-59, with tax-free income after reaching age 60.

How does a transition to retirement strategy work?

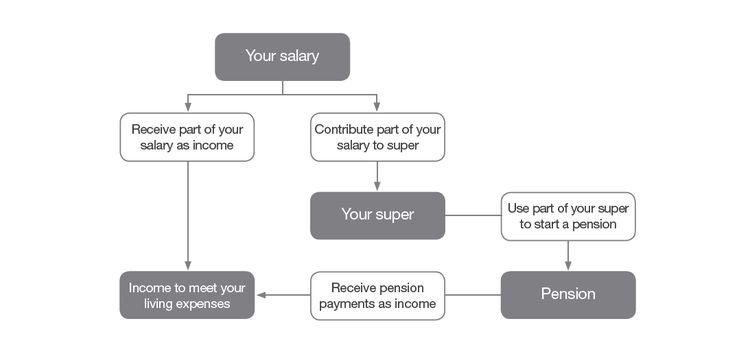

There are two main parts to a transition to retirement strategy:

- Directing a portion of your salary into superannuation, known as salary sacrifice.

- Replacing the income you direct into superannuation with a regular payment from your super savings, otherwise known as a ‘pension’.

A transition to retirement strategy changes the way you receive your income. Instead of receiving your income from one source (your employer), you receive income from two sources (your employer and your superannuation savings).

Can this strategy save you tax?

The benefit of an NCAP strategy comes from the differing tax rates that apply to regular income, superannuation and pensions.

Lower rates of tax generally apply to super, compared with the marginal tax rates on income. This advantage is further increased because any investment earnings in an NCAP will be tax free.

How transition to retirement works

Your superannuation pension is taxed at more favourable rates than your salary. So, to replace your salary with a pension, you can draw a smaller amount from super and receive the same amount in your pocket. This means that your superannuation savings should still grow each year.

Pulling it all together

A transition to retirement strategy can be an effective way to boost your superannuation savings. But how much your savings grow will depend on the contributions you make into super through salary sacrifice, compared with the amount you withdraw as your pension. If you take out more money than you put back in, your savings will decline in value. This will result in you having less money to fund your retirement when you stop working altogether.

We can help you strike the right balance and determine whether a transition to retirement strategy is the best way for you to maintain your income and lifestyle as you move towards retirement.

Michael’s story

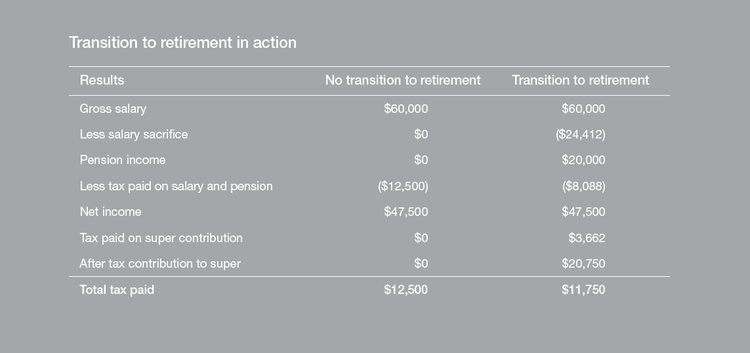

Michael has reached 55 and starts a transition to retirement strategy. Michael’s gross salary is $60,000 per year. He has accumulated $200,000 in super savings, and elects to use the full amount to start a non-commutable pension. Together with Michael’s pension income, he can salary sacrifice $24,412 per annum and still receive the same amount of money in his pocket.

After a year, the transition to retirement strategy has resulted in:

- Michael paying $750 less tax.

- An increase of $750 in Michael’s superannuation balance (a withdrawal of $20,000 and an after tax contribution of $20,750).

- The income that Michael has earned on the $200,000 in his pension account will not be taxed (if these funds remained in his super account, the earnings would be taxed at 15 per cent).

- After 10 years, it is estimated that Michael will have an additional $50,000 in superannuation savings as a result of implementing the transition to retirement strategy.