People often make unwise or hasty decisions when they’re under stress. And a growing number of Australian households have found themselves under stress, both financially and non-financially, during the COVID-19 pandemic. It’s at these times the value of professional advice really comes to the fore.

CoreData recently published a white paper, The post-pandemic advice landscape. It’s a free download, and you can get your copy here. One of the findings of the research underpinning the paper that really stands out is the difference that exists between households that receive financial advice and those that do not.

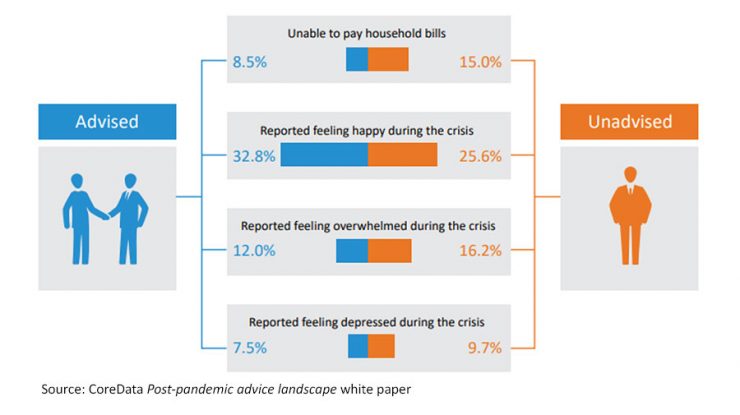

CoreData’s quarterly COVID-19 Pulse Check surveys were conducted regularly during the pandemic and they paint a picture … For example, around 15 per cent of unadvised households reported being unable to pay household bills, a figure just less than double the 8.5 per cent of advised households reporting the same issue.

About 16 per cent of unadvised households report feeling overwhelmed during the pandemic, compared to 12 per cent of advised households. And feelings of depression were reported more often in unadvised households than in advised households.

We know from other work that people who receive financial advice report being demonstrably financially better off, and report lower levels of stress and worry about financial issues. Better financial wellbeing flows into better overall wellbeing – people who receive financial advice sleep better, and they don’t have financial worries spilling over and affecting their personal relationships.

Demand up, but supply down

As reported by New Model Adviser last week, just when it looks like demand for financial advice is set to grow, accessibility is diminishing as more advisers leave the industry. CoreData’s latest analysis shows more than 7000 advisers have left the industry since a peak of more than 28,000 at the end of 2018, and numbers continue to decline.There’s a high chance that a client or a family member of a client has been affected adversely by the pandemic.

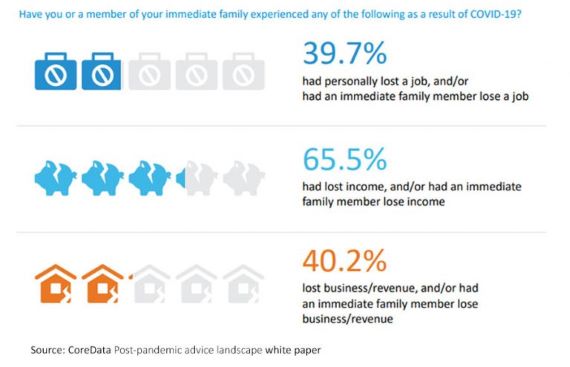

CoreData’s research shows that almost four in 10 (39.7%) people have personally lost their job or had an immediate family member lose their job. Furthermore, almost two-thirds (65.5%) of people have personally lost income or had an immediate family member lose income. And four in 10 (40.2%) people who run a business have personally seen it lose revenue, or had an immediate family running a business that has lost revenue.

There will be some short-term pain within the industry itself, as well, with the research finding that average loss of revenue within the 12 months since the pandemic started is expected to be about $90,000 per practice. Some practices will be able to cope with the loss; some will find the loss more difficult to deal with; and for some practices, it could be the difference between profitability and a loss for the year.

The post-pandemic white paper points out that the value of advice is being proven even as we speak, and the future for the profession looks bright. Some of the changes wrought by COVID-19 will have permanent and far-reaching consequences for how advice firms are structured and how they operate – mostly for the better.

And the impact on adviser-client relationships is likely to be strengthened as well as advisers prove the value of their services through some of the most difficult economic and social conditions in living memory.

The post-pandemic advice landscape white paper: Key points

1. Trust in advisers is on the rise as client relationships strengthen:

Advised Australians are faring markedly better throughout the crisis, and many advisers are reporting notable increases in the strength and quality of their client relationships.

2. COVID-19 is expected to drive demand for advice

Advisers predicting an increase in demand for advice post COVID-19 see it as an opportunity to grow client bases by demonstrating value. However, many acknowledge that the virus has widened the “advice gap”.

3. Digital and remote working is creating efficiencies

Advice businesses have been forced to adapt at lightning speed to conducting business digitally. Advisers and practices alike are already seeing the operational efficiencies that these tools bring; many shifting to flexible working arrangements.

4. Advisers have adapted well to FASEA

The majority have already taken the FASEA exam, achieving a self-reported pass rate of more than 80 per cent. most advisers already hold, or expect to hold, an approved bachelor’s degree or equivalent or higher before the January 2026 deadline.

5. The future is bright

While many advisers are pessimistic about the outlook for the economy, they remain upbeat about the prospects for business.

Please contact us on 02 9150 9555 if you seek further assistance on this topic.

Source : Coredata November 2020

By Simon Hoyle Head of market insight at CoreData Group

Reproduced with the permission of CoreData Research. This article was originally published on New Model Adviser , a website powered by CoreData Research, showcasing its research and insights on financial advice: the profession, advisers, advice practices, licensees, legislation and more.

Important: This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Although the information is from sources considered reliable, we do not guarantee that it is accurate or complete. You should not rely upon it and should seek qualified advice before making any investment decision. Except where liability under any statute cannot be excluded, we do not accept any liability (whether under contract, tort or otherwise) for any resulting loss or damage of the reader or any other person. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.